It is imperative that a cost analysis is completed in order to know what it really costs to do business. An annual cost analysis determines the actual cost of providing services/products. Users are then charged for actual usage based on the rate schedule of these costs.

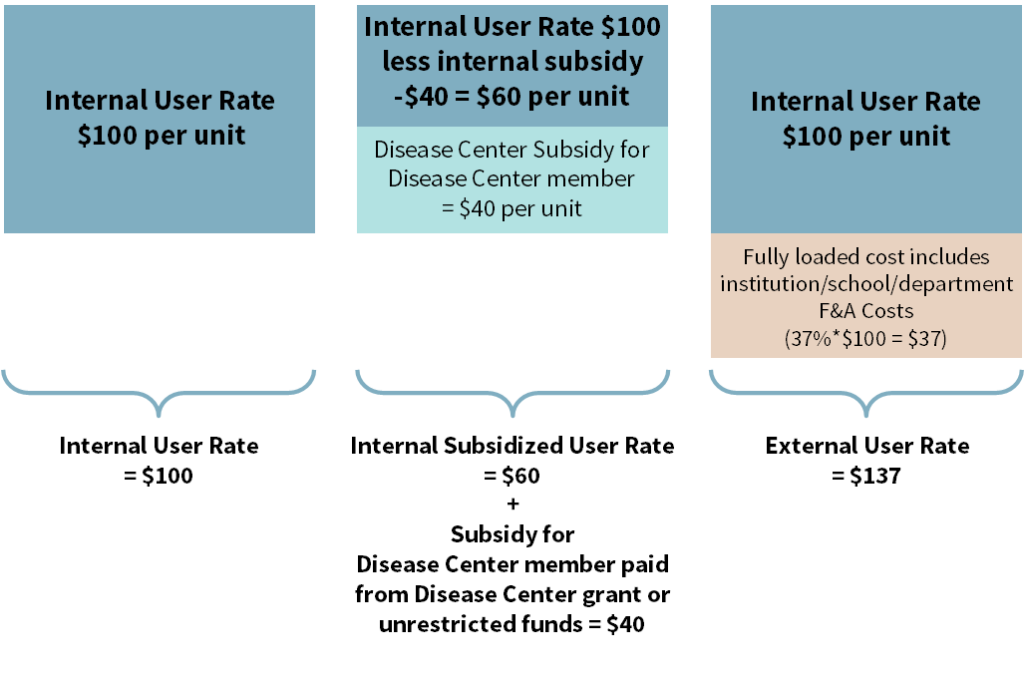

There are defined situations when an RC/SSF may offer subsidized rates to users. A subsidy is a financial contribution made to a center creating a benefit to some or all users of that center, typically resulting in a reduced user fee. The RC/SSF should factor into the cost analysis the amount of the subsidy, the affected user population, and the affected services/products. The difference between the reduced rate and the full cost is the amount of the subsidy.

There is no “free” or “reduced rate” service to any user without another funding source specifically subsidizing the costs for those users. An RC/SSF recovers the full cost of services/products provided to subsidized users by charging the difference between the full rate and the subsidized rate to the core grant, department, or school or university providing the subsidy. When implementing subsidies, consistency with federal policy is key so that rates do not “discriminate against federally supported activities of the institution, including usage by the institution for internal purposes,” and are “designed to recover only the aggregate costs of the services”. Volume discounts or other special pricing mechanisms must be equally available to all users who meet the criteria. Development and application of subsidized rates should be well documented.

There are two main types of subsidies to consider when developing charging methodologies:

A. Center/Facility Subsidy

A subsidy provided to all internal service users. A RC/SSF may receive funding that allows the center/facility to offer a lower rate to all users (normally just internal users) which recovers less than the total cost of the RC/SSF’s services/products. The subsidy is the difference between the rate that would recover the total cost and the reduced charge to users. The subsidy may be funded by a department, school, or the university. Quite often, users aren’t even aware of this type of overall subsidy.

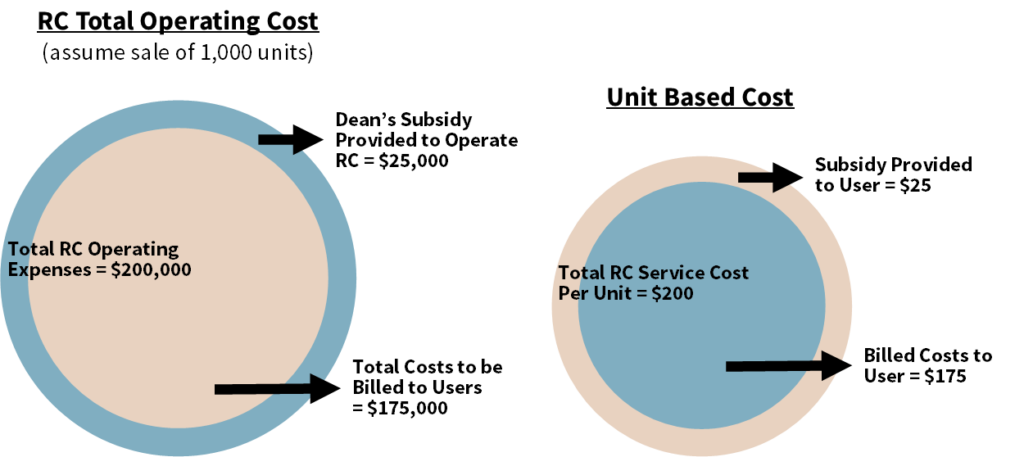

Example: Assume a RC’s expenses total $200,000, and it expects to provide 1,000 units (services/products) to users during the year. The unsubsidized rate would be $200.00 per unit. If an overall subsidy of $25,000 is provided by the Dean to operate the RC, the charge to all internal users would be $175.00 per unit. (See worksheet example “Center with Subsidy” tab (XLS).)

B. User Subsidy

A subsidy provided to a defined group of service users. A RC/SSF may receive funding that allows them to offer a lower rate to a targeted user group. A user level subsidy must be consistently applied to the defined set of service users. This group of users would receive an invoice documenting the full service rate less the amount of the defined subsidy. The user then pays a fee that is lower than the full rate charged to unsubsidized users.

Example: Assume a cost of $75.00 per unit (service/product), and a department strategically plans to have its investigators pay a lower amount. The department has to provide a subsidy that would be funded from its departmental budget or other resources. The department wants its users to pay no more than $50.00 per unit so the department would provide a $25.00 per unit subsidy to the RC/SSF for any services provided to that department’s users.

Key Subsidy Guidelines to Remember

- Subsidy eligibility should be clearly defined

- Subsidies should be properly factored into the cost analysis

- Subsidy rates should be consistently applied to the defined user groups

- Subsidy calculations should be reviewed on at least an annual basis in order to compare the actual dollar value of subsidies applied to billings versus the total dollars of support provided to the RC/SSF

- User subsidies should be documented on invoices

Recharge and Core Facilities Supported by Sponsored Project Funds

In some cases, federal grants or other sponsored awards may support research core facilities. A core established under a sponsored project award to strictly provide services/products to investigators involved in the specific scope of research supported by this grant could be referred to as a “closed core.”

Under a closed core there are two primary scenarios where users may be charged by the core facility even though a sponsored project award is providing operating funds. The amounts to be billed under both scenarios below should be considered and treated as program income to the grant funded project.

Scenario A

The grant does not provide funding for all of the costs associated with running the core to provide services/products to investigators involved in the scope of research supported by this grant. For example, the grant supports salaries/fringes, but not supply or other costs associated with providing the core services/products. These non-personnel costs which the grant does not fund, may be billed to this defined group of investigators and these expenses would be charged directly to the grant program income account/allocation. (See Account Set-up/Program Income for details on managing this revenue.)

Scenario B

Investigators not associated with this grant’s scope of research (as described in Scenario A) want to access services/products from this core, and the core has the excess capacity to provide these additional services/products. The investigators not formally linked to this grant would be billed for both the personnel and non-personnel related costs and these expenses would be charged directly to the program income account/allocation. (Note: Personnel costs for these services provided outside the scope of the grant project need to be removed from the grant since these costs will be billed out and then charged to the program income account.) (See Account Set-Up/Program Income for details on managing this revenue.)

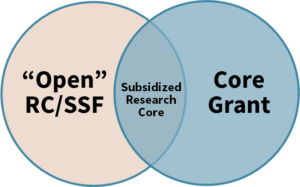

As opposed to a closed core established under a specific grant protocol, an existing RC/SSF established to provide services/products without restriction toward user groups could be viewed as an “open core”. Situations do arise when a RC/SSF (open core) already in existence receives grant funding at a later point in time to support a portion of the RC/SSF activities (see diagram below). Different scenarios are possible, but in each case the investigators involved in the protocol of the funded grant would receive a subsidy based on the contribution the grant is making to the RC/SSF operations to prevent the RC/SSF from recovering costs directly from the grant and also billing the grant specific investigators for the same costs.

Note: When sponsored project awards are funding all or a portion of a core, you must determine if the revenue earned is strictly due to the existence of the sponsored project award and must therefore be managed as program income:

- If a core facility is created by a grant award, then charges for services/products to users requires that the fee-for-service activity be tracked as program income against the grant which is funding the core facility.

- If a RC/SSF providing services/products already exists and an award is subsequently received to support a portion of the center’s activity, then the fee-for-service income would continue to be recorded as standard RC/SSF re-charge activity and would not have to be tracked as program income associated with the newly awarded grant.

When it is determined that revenue earned is strictly due to the existence of the sponsored project award, this revenue and the associated expenses are considered program income and would be managed under two FIS accounts as described in the Program Income Account Set-Up Section.

Cost and Rates for Different Users

Is it allowable to charge different rates for equipment use during peak, non-peak and late night non-standard hours?

Charging different rates based solely on the time the service is obtained is not appropriate. The costs incurred during the different time periods would have to be different in order to charge multiple rates. For example, labor costs would need to be more/less during those periods (e.g., daytime staff = 3 FTE, but night time staff = 1 FTE).

Can different rates be offered to users based on different service volume levels?

Yes, the RC/SSF can offer differing rates based on volume, if, in fact, there is a real price difference. For example: Labor costs may be only twice as much when making 100 units vs. making 10 units.

Can we adjust our RC/SSF rates mid-year, or do we have to make the change at the beginning of the WashU fiscal year, July 1st?

Yes, you can adjust your rates mid-year; they can be adjusted at any time throughout the fiscal year. At minimum, rates must be reviewed annually, but can be reviewed more often if needed. Rates should be adjusted if expenses or volume vary significantly from budget estimates. When implementing new rates it is advisable to give users sufficient notice for budget planning purposes, especially if rates are being increased. Note that the documentation requirements apply to any rate changes no matter when they occur. For additional information visit the Annual & Ongoing Review Process page.