The first step to developing rates for products/services is to identify the various cost elements.

Measurable Units

Recharge centers must bill users for actual usage; therefore a measurable unit must be identified. The unit must be something that can be measured, quantified and tracked in a reasonably accurate manner. In some cases, a recharge center may utilize several types of “measurable units” that are associated with the specific product or service provided. Examples are noted below:

| Daily Rate | • Fixed rate for a full “day” of service • Daily rate for utilizing a scientific machine • Daily rate for consultation by faculty/staff |

| Annual Rate (should be billed at least quarterly) | • Fixed rate for data base access |

| Labor Hour | • Number of hours that personnel dedicated to performing service • Calculation based on the % of time the employee is working in the center. Evaluate the % of time worked to calculate the salary to include. • If you have variable salaries, calculate each individually. Do not average them. |

| Machine Hour | • Number of hours an investigator uses a microscope or other machine |

| Consultation Hour | Related to timeframe consultant spent on the specific issue/project • Number of staff hours spent analyzing data • Number of faculty hours spent developing statistical model • Number of hours spent to train new user |

| Page | • Number of pages (pieces of paper) utilized by the user • Number pages generated by the copy machine or color printer |

| Liquid Volume | • Measure of liquid (i.e., milliliters, cubic centimeters) that are analyzed |

| CPU Unit | • Relates to computer CPU utilization required for test/project |

| Test | • Relates to a standard scientific or patient care test |

| Slide | • Number of scientific slides, tissue sample slides, bacteria slides, etc., analyzed |

| Sequence | • Measurement used for DNA sample sequencing |

Once the measurable unit is established you can move on to identifying cost elements to be incurred by the RC/SSF.

Operating Costs

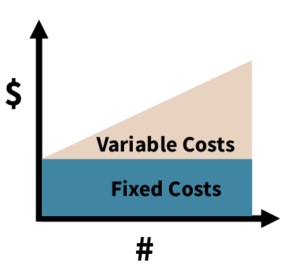

| Operating Costs = (1) Fixed costs + (2) Variable Costs |

|---|

(1) Fixed Costs:

- Costs that are not contingent on RC/SSF volume

- Costs/obligations that are predictable with a high degree of certainty

(2) Variable Costs:

- Costs that change in proportion to volume or activity of the RC/SSF

- Costs/obligations that can only be estimated based on analysis of historical and prospective RC/SSF volume activity/data

Operating Costs – New RC/SSF

- Fixed costs estimates should be estimated by knowledge of what resources (personnel and non-personnel) will be needed to run recharge center.

- Variable costs should be estimated based on realistic volume estimates.

Operating Costs – Existing RC/SSF

- Fixed costs should utilize historical information/data and knowledge of changes projected for the coming period.

- Variable costs should be estimated based on projected volumes for the coming period.

- Both fixed and variable cost estimates will benefit from performing a variance analysis between the prior fiscal year budget and prior fiscal year actual costs. Include review of the assumptions made and comparing them to actual outcomes.

- Due to the requirement for RC/SSF to breakeven over a period of time (currently defined by Washington University as five years for a deficit unless an exception is granted and three years for a surplus), an analysis of prior year cumulative operating deficits or surpluses must be done and any deficits or surpluses must also be applied when developing annual rates.

Non-Recoverable Costs

Listed below are some of the various types of costs which cannot be included in a RC/SSF rate for internal users:

- Indirect costs related to service centers such as labor costs for department administrators who are not directly involved in the day-to-day operation of the center.

- Building operation and maintenance expenses (utilities, maintenance, custodial services, and building depreciation) are an allowable cost for an SSF, but not for an RC.

- Equipment depreciation is non-recoverable if the equipment was purchased on a federally sponsored project account.

- RCs/SSFs must be managed in accordance with OMB Uniform Guidance applying the standard rules regarding unallowable costs (See 2CFR §200.400).

- To adjust for the unallocable expenses (EX: dependent tuition), run RPT6778 and go to the non-allocable section of the report for the adjustment amount.

Examples of Common Non-allocable Costs

See RPT6163 for current unallocable spend categories.

- §200.438 Entertainment costs (SC229, SC199, SC226, SC248, SC524, SC525)

- §200.431 Dependent Tuition benefits for family members other than the employee. (Ledger 57040)

- §200.439 Equipment and other capital expenditures

- §200.455 Organization costs (incorporation fees, management consultants, attorneys)

- §200.459 Professional Service costs (professional fees and consulting other)

Other Job Costing/Rate Development Considerations

- Costs that are included in the computation of RC/SSF rates should be consistently included each year if the costs are incurred for the same purpose in like circumstances.

- The use of market prices to establish billing rates for internal customers would not be appropriate to the extent that market prices include a profit. It may be appropriate to use market prices for establishing billing rates for external (non-Washington University) customers.

- An RC/SSF may charge additional fees to external (non-Washington University) customers.

- Cumulative surplus from prior years operating results would be considered when developing annual rates.

- An RC/SSF is expected to operate close to break-even over a period of time, currently defined by Washington University policy as no longer than a rolling five (5) year period for a deficit unless an exception is granted and three (3) years for a surplus. Break-even occurs when costs of services/products is equal to the recharge revenue received from customers.

- Monitoring operating revenues and expenditures is the usual method for determining break-even compliance.

- Expenditures for capitalized equipment purchases (including principle payments on debt) are not to be included in the costs used to establish service center billing rates. (Note: See “Fixed Costs Examples” regarding equipment depreciation.)

- In order to estimate usage, prior year(s) numbers can be used as a starting point and adjusted for anticipated changes. Centers without sufficient usage history can use available units as a starting point and adjust for downtime and other intervening factors.

Examples

Fixed Cost Examples:

Personnel

An appropriate portion of the salaries and fringe benefits of all personnel directly involved in service center activities such as: lab technicians, equipment operators, nurses, etc. The salaries and benefits of any administrative staff or other personnel supporting a service center are included in the rate calculation to the extent that their time is devoted to this function. Subject to appropriate review and approval, these costs are allowable as long as they are reasonable, are consistently applied, and reflect no more than the percentage of time actually devoted to the service center function. The allocable portion of salaries and fringe benefits should be recorded each month in the service center account(s).

Non-Personnel

An appropriate portion of fixed costs for non-personnel items directly involved in service center activities such as: equipment maintenance or service agreements, equipment rental, licenses and fees.

Equipment Depreciation

Depreciation of equipment purchased on sponsored project accounts should not be included in internal user rates.

Building operation and maintenance expenses: Utilities, maintenance, custodial services, and building depreciation are typically fixed costs and can be included in the rates for SSFs, but are excluded from the rates for RCs.

Variable Cost Examples:

Consumable Supplies

Costs incurred for the purchase of supplies, materials, and fabricated parts to be used or consumed in the process of providing services or products. Examples include chemicals, media, lab supplies, data storage devices, animals, syringes, needles, etc.

Other Expenses

Laboratory fees; technical procedure fees; shipping; data storage; specimen storage; gases; equipment maintenance charges such as calibration costs, repairs and certifications; contractual services such as: dry ice and medical gases, and freezer monitoring; and other directly-related expenses (e.g., shipping/postage).

In addition to the costs listed above, other variable costs may be allowable for a particular RCC/SSF if in accordance with Washington University policy. (Confirm with Washington University Cost Analysis Office prior to including in rate).